TMT Daily Focus List: Weekly Watchlist (July 27th- August 1st)

- Weekly Watchlist 7/27-8/1, 2025 - additions daily

Market Macro

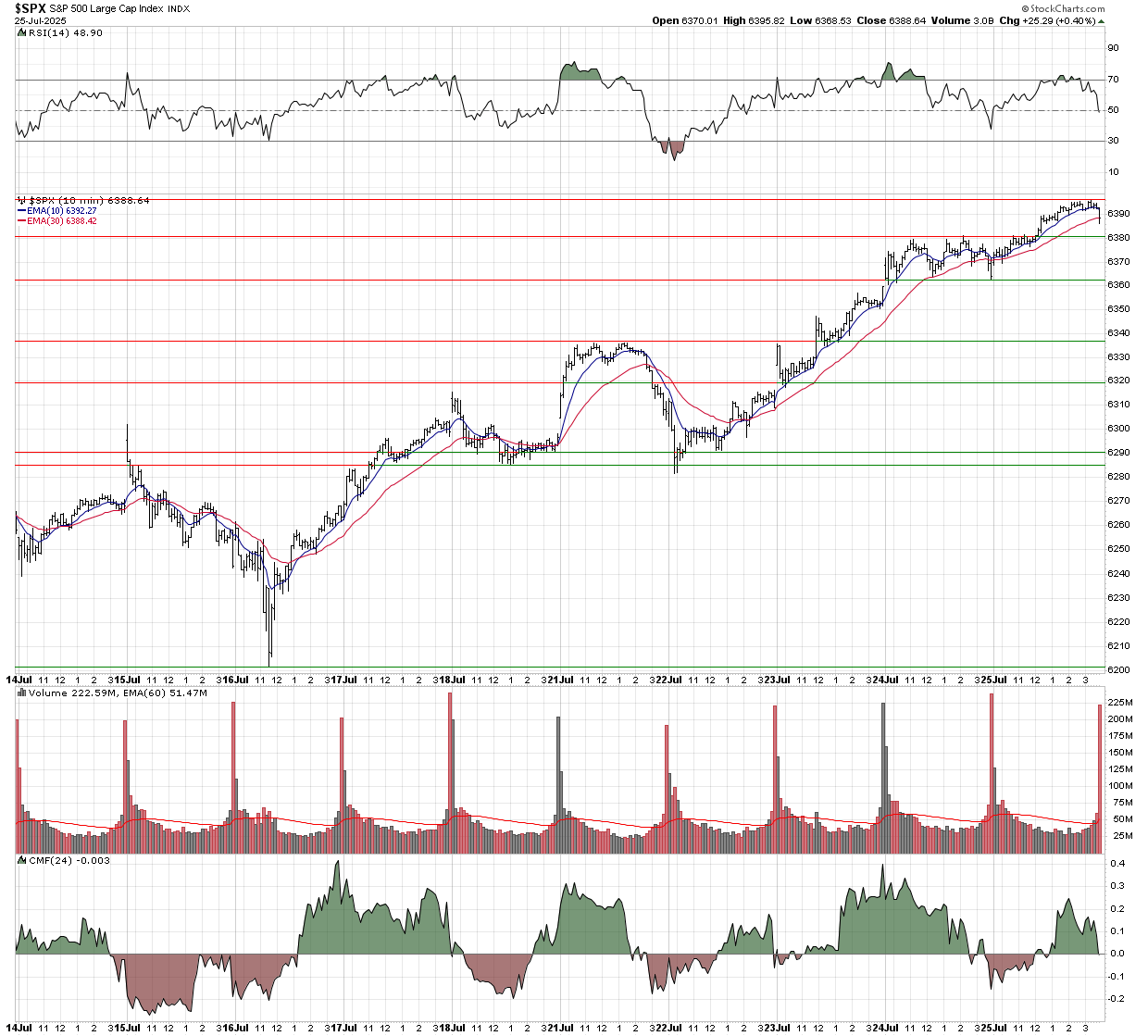

S&P 500 ($SPX) - Could find support on a shallow pullback around $6380 and below at just above $6350. Further down we have an area around $6320 and then below $6300 around $6285. If we break down here, the 21-EMA on the daily is around $6250, which could act as support. Below that, $6200 is a major level as the index would be near the past all-time highs from earlier this March around $6150.

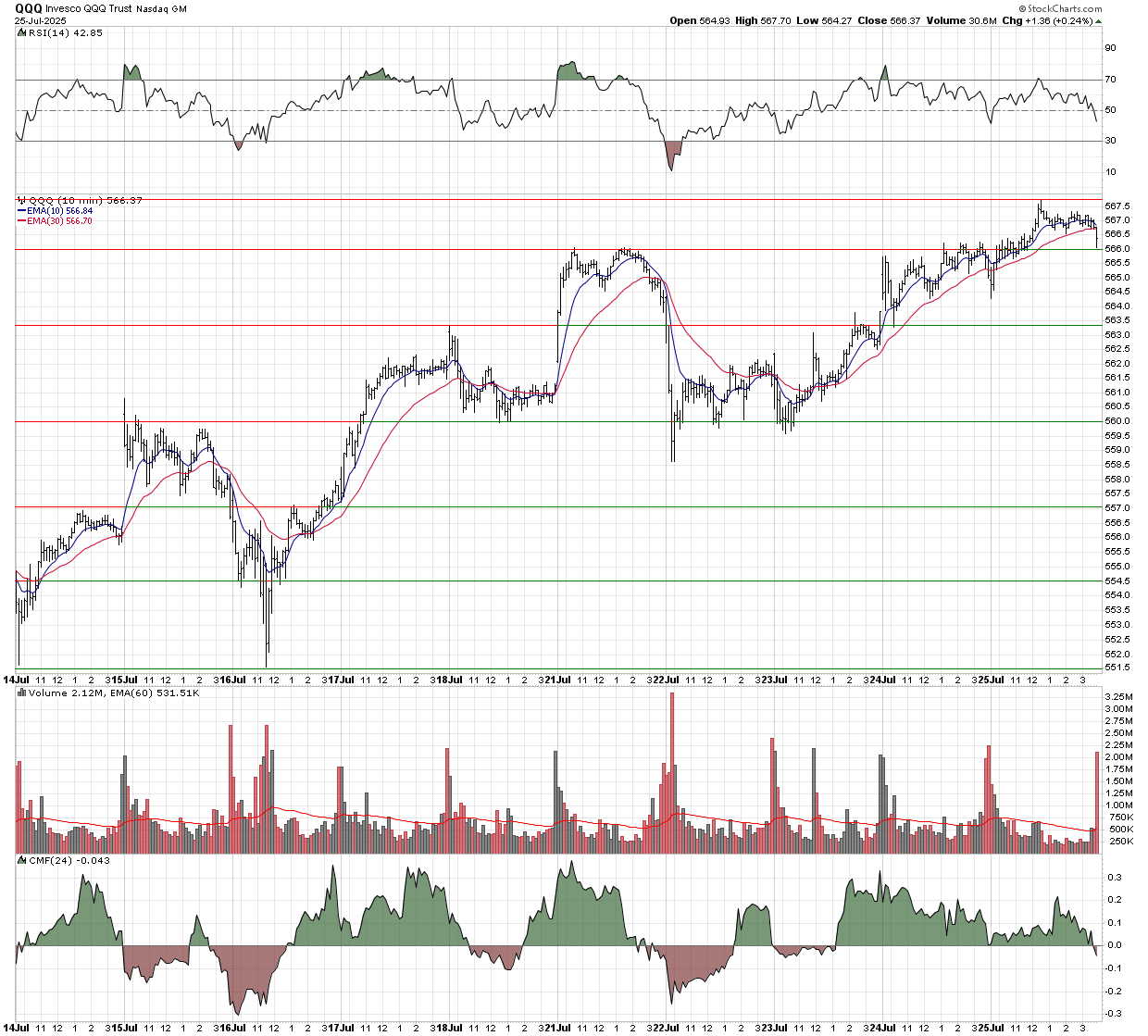

QQQ Trust (QQQ) - There was an early break on Tuesday of $560, but within 20 minutes it was back north of $560, which then acted as support over the next day before another move up to record highs by Friday. We may find support on a shallow pullback around Friday’s highs near $567.50 or below at $566 if buyers are active today. If we pull back further, I think just above $564 and down through $563 is another good level to look for chart support, with $560 being the most important near-term support level.

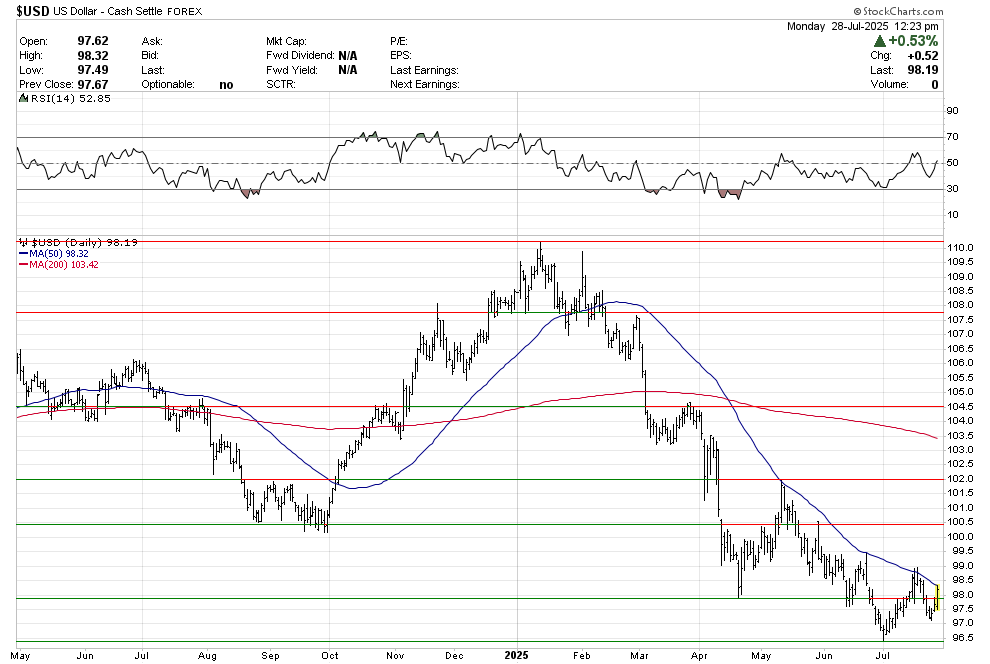

U.S. Dollar - I really like the odds of a dollar counter rally here. The greenback has been under pressure for about 6 months, and a breakout this week over the 50-day SMA could create a move to $99 and even top the $100 if this potential counter rally gets legs. One way to play this would be to buy UUP, which tracks the index, or a more advanced method would be to buy a currency pair.

Market Heavyweights - Mag 7

This is a watchlist to keep tabs on stocks with heavy weightings in the indexes. Good to have on a watchlist and monitor their movements as they correlate with the major averages.