- Weekly Watchlist 7/7-7/11, 2025 - additions daily

Market Macro

S&P 500 ($SPX) - If buyers stay active, I think we will find support near the gap or above around $6230 or $6250. If the market breaks lower, around $6200/$6210 could be a significant area to watch for support. Below that, the old all-time highs are around $6150 but the chart support is at $6175 and below at $6135.

QQQ Trust (QQQ) - Looking for immediate support at $551 and $553, with $545/$546 being a critical level for this up leg. If the trend is going to keep running into earnings season, I wouldn’t expect a move back below $545 to occur. So will watch the price action closely on any pullback toward $550 this week.

S&P 400 Mid-Caps - We had a breakout last week over a critical level around $3100, which could now turn into key support on any serious pullback. We may have an area of resistance at $3225, but if we see the buyers continue to pound in, $3300 could be the landing spot on this leg. With the slowdown in the job market and lack of any negative prints, these high-risk stocks have been seeing money flow into them over the last week and that very well could be the theme again this upcoming week.

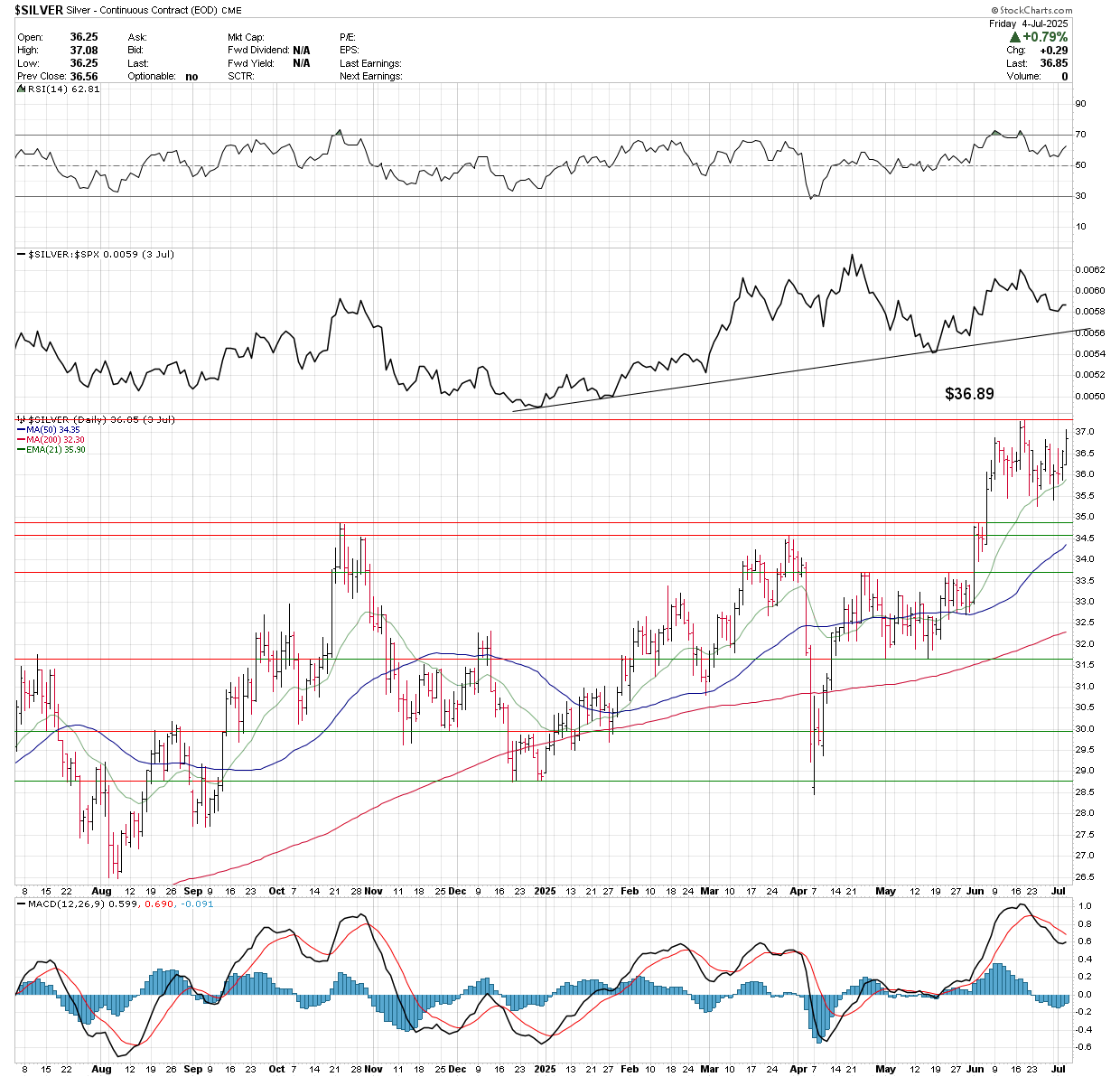

$Silver - Interesting setup here as I like the support recently around the 21-EMA average. If we see support with the gap lower today with little selling in the session, it could be a good dip to buy — as the RSI is coming back up after a move toward 50 as the relative strength is still trending higher. Plus, silver outperforms gold later in the cycle.

Market Heavyweights - Mag 7

This is a watchlist to keep tabs on stocks with heavy weightings in the indexes. Good to have on a watchlist and monitor their movements as they correlate with the major averages.