- Weekly Watchlist 7/14, 7/18 2025 - additions daily

Market Macro

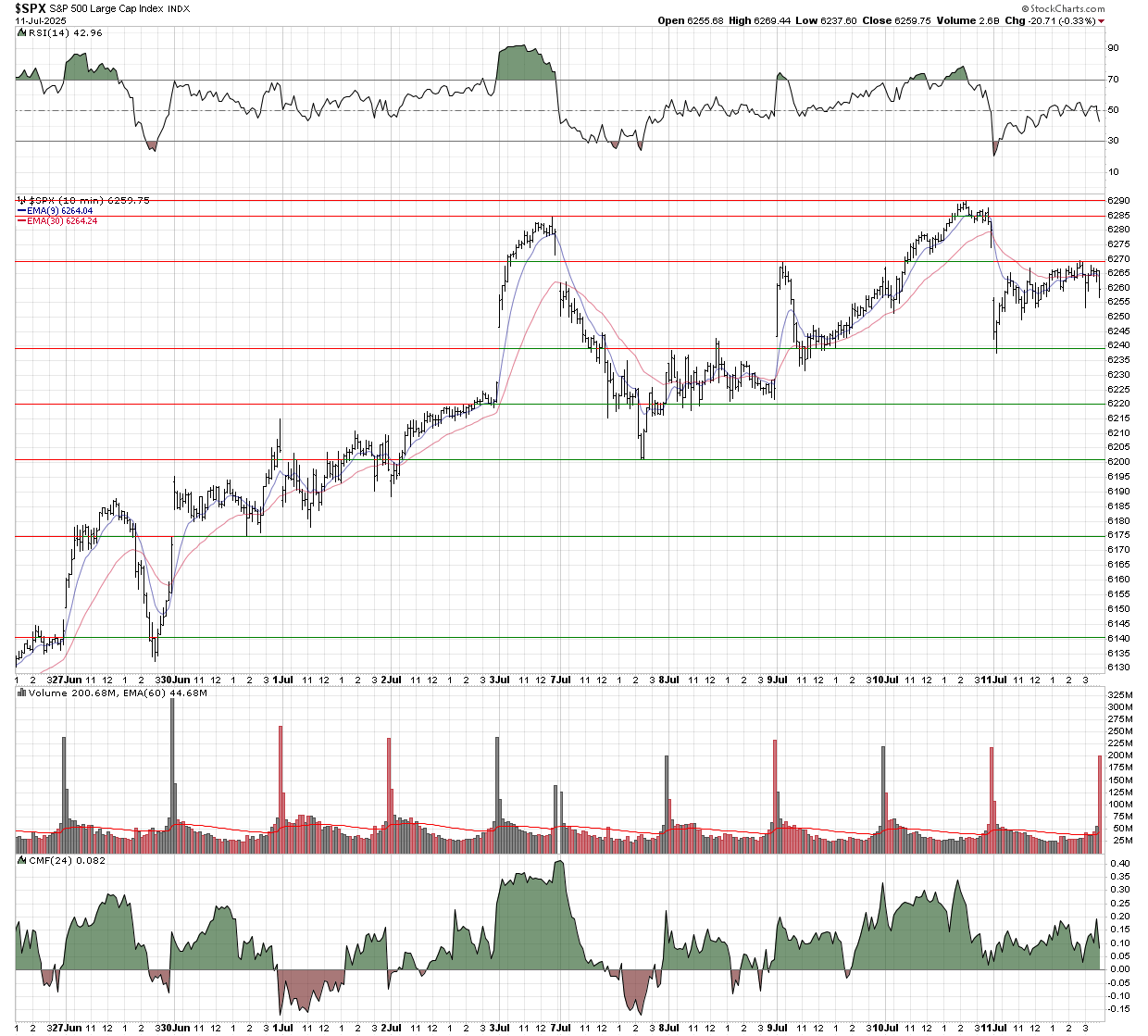

S&P 500 ($SPX) - Always like to break down the indices a bit more before the week starts, and this is a ten-minute chart over the last few weeks. There is an area of resistance overhead at $6270 with $6285/$6290 being the recent highs. There may be good support through and possibly above the $6220 and $6240 areas. Then below there could be possible to support at $6200, $6175, and $6140/$6150. With the 21 EMA on the daily, which is not pictured at $6144.53 to start the week.

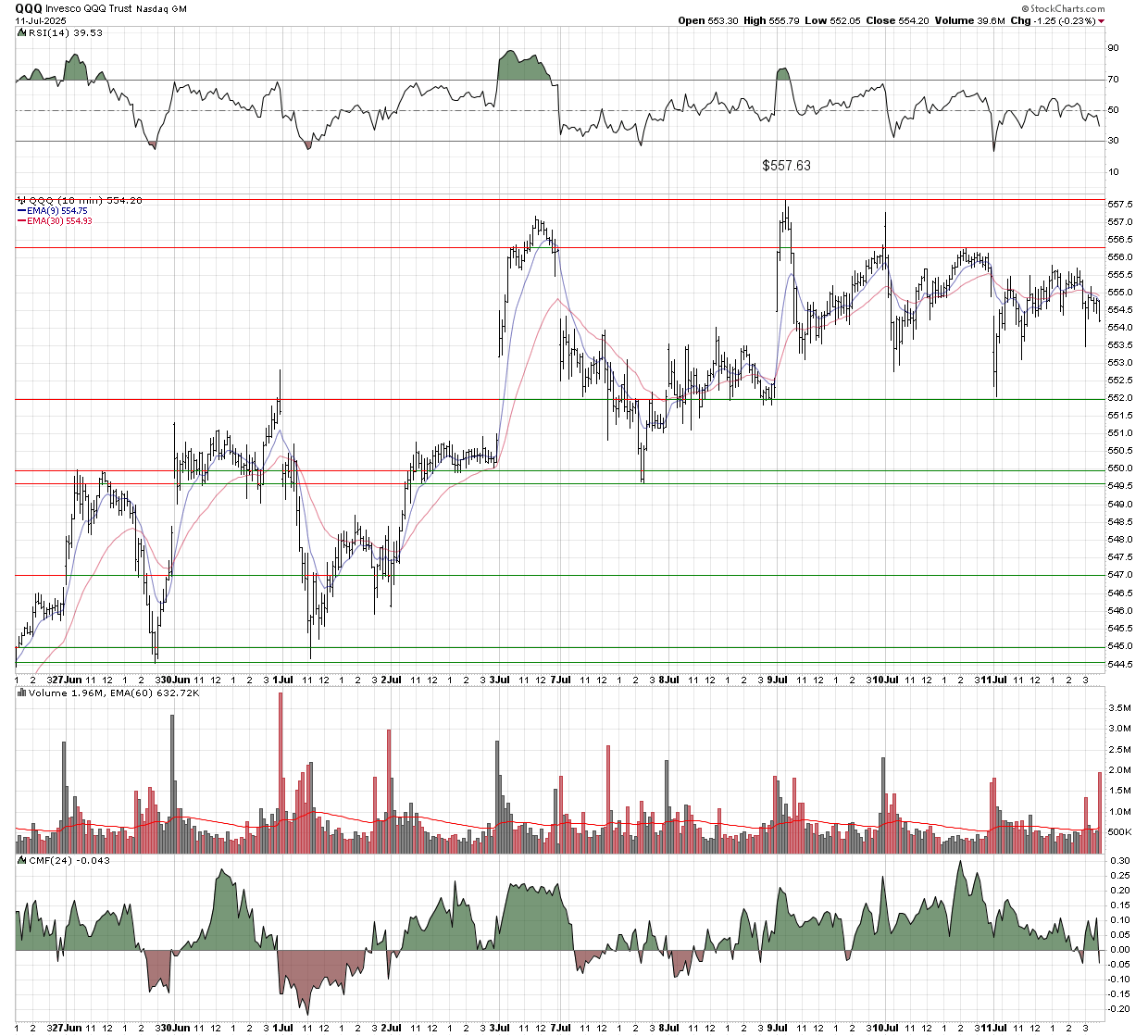

QQQ Trust (QQQ) - Recent highs are at $557.63, with an area around $556.25 resistance, as if we get over this area, we could trade at new all-time highs or at minimum a test of them. The Support area is around $550/$552, which I expect to be active today providing support or at minimum a gravitational pull. If we are to break $550, it could be a signal of a more serious pullback in the works, with $545 being an important support level as we would get close top the previous highs from earlier this year just under $541.

$Silver - Broke higher in a big way last week and has been clawing back some relative performance from gold, as is often the case later in the cycle. The 21-EMA has been supporting the price action of late and I expect this to continue and the commodity to stay north of the recent highs, just under $37.50 on any pullback in the short-term.

Market Heavyweights - Mag 7

This is a watchlist to keep tabs on stocks with heavy weightings in the indexes. Good to have on a watchlist and monitor their movements as they correlate with the major averages.