TMT Market Report #129

Powell takes a hawkish stance as big charges out of technology companies helped pushed stocks lower. Will earnings provide a boost or continue to weigh on sentiment? Let's get ready for another week.

Welcome to The Merciless Trade, where I break down significant updates in the financial markets and find connections between them. Preparing you for the week ahead as I flip through charts, analyze the data, and cut through the noise to get an edge.

Now let’s do this…

Last week we saw a mixed bag of performance out of the major indexes and sub-indexes that make up the markets. There was out performance in smaller cohorts of stock in the Russell 2000 and also mid-caps, while the equal weight indexes outperformed handily, finishing up by 1.86% on the S&P 500 and up by 1.03% for the Nasdaq 100 equal weight indexes. Most of the selling took place in big caps names such as META, Microsoft, Amazon, and particularly Nvidia which will take a 5.5-billion-dollar charge regarding the tariff’s restrictions limiting the sale of their H20 in China. This sent ripples through the sector as many large cap AI plays, the best performers of the last few years, struggled this past week. Also, there was a big move down over 20% on UnitedHealthcare as a weak forecast and results sent its stock and the Dow Jones tumbling lower.

Powell this past Wednesday also added to the negative vibes by sending stocks sharply lower as he stated his desire about the Fed standing firm on rates in the face of tariffs. He signaled all things equal that the Fed’s priority as of today should lean toward stable prices. He also noted that car supply chain disruptions could persist for years, possibly leading to persistent inflation. While Powell has often made it clear that the Fed will act in a recession if the economy weakens. This week, he didn’t mince any words and was direct and firm on price stability being the top concern until the data changes.

The market initially sold off on the news but recovered most of the losses incurred during Powells speech by the Thursday close. Also, this past week the Italy premier Giorgia Meloni came to the WH, as did many in the Japanese delegation. Tariffs have caused many foreign leaders to head to Washington to seek a deal or at a minimum to better understand Washington’s demands. Kevin Hassett, The National Economic Council Director said this past week the WH has over 15 deals in the works, but it’s important to note not one preliminary deal has yet signed. These deals could be positive catalyst’s that develop in the coming weeks and need to be monitored as the faster they get to an agreement the better it be received by markets.

The past week in economic news we saw retail sales come in better than expectations at 1.4% compared to the 1.3% expectations as the consumer is still spending. This may be a resilient consumer or could show the spending that is front-running many of the price increases that are taking place in consumer products. Also, we got housing starts for March last week that fell by the largest amount in a year, reaching 1.324 million, below the estimated 1.494 million.

Here are the other economic data highlights from the past week:

Housing Starts (Mar) 1.324M Vs 1.420M Est.; 1.494M Prior

Continuing Jobless Claims 1,885K Vs 1,870K Est: 1,844K Prior

Initial Jobless Claims 215K Vs 225K Est.; 224K Prior

Philadelphia Fed Manufacturing Index (Apr) -26.4 vs 2.2 Est.

Crude Oil Inventories 0.515M Barrel Build Vs 0.400M Barrel Build Est.; 2.553M Barrel Build Prior

Gasoline Inventories 1.958M Barrel Draw Vs 1.600M Barrel Draw Est.; 1.600M Barrel Draw Prior

EIA Weekly Distillates Stocks 1.851M Barrel Draw Vs 1.200M Barrel Draw Est.; 3.544M Barrel Draw Prior

Business Inventories (MoM) (Feb) 0.2% Vs 0.3% Est.; 0.3% Prior

NAHB Housing Market Index (Apr) 40 Vs 38 Est.; 39 Prior

Industrial Production (MoM) (Mar) -0.3% vs -0.2% Est.; Prior +0.8%

Capacity Utilization Rate (Mar) 77.8% vs 78% Est.; Prior 78.2%

Retail Sales (MoM) For (March) 1.4% Vs 1.3%; 0.2% Prior

Core Retail Sales (MoM) (Mar) +0.5% vs +0.4% Est.; Prior +0.7%

Import Price Index (MoM) (Mar) -0.1% Vs 0.1% Est.; 0.2% Prior

Export Price Index (MoM) (Mar) 0.0% Vs 0.1% Est.; 0.5% Prior

NY Empire State Manufacturing Index (Apr) -8.1 vs -12.80 Est.; Prior -20

Redbook (YoY) 6.6% Vs 7.2% Prior

- Treasury Market -

Yields this past week settled down across the curve as the 10-Year benchmark closed at 4.33% down 16 basis points. While the 2-Year moved lower by 17 basis points to close at 3.81% with the long end of the curve and the 30-Year bond down just by 8 basis points to close at 4.80%. Elevated yields remain and even with the broad pullback, we still have a dislocation from historical correlations. This will continue to be important to follow in the coming weeks and months to see if bonds fall back into more normal historical correlations.

The 2-Year closed at 3.81%

The 5-Year closed at 3.94%

The 10-Year closed at 4.33%

The 20-Year closed at 4.84%

The 30-year closed at 4.80%

For the May 7th odds rose to 88.8% from 60.2% that the Fed will remain on hold with no rate cuts, with a 13.2% probability of a 25-basis point rate cut down from 39.8% in the prior.

For the June 18th meeting there is now a 54.2% up from 49.6% chance we see a 25-basis point cut. While we now see a 38.5% chance of no rate cut up from 31.3% in the prior week. The rate is now 7.4% following a 50-basis-point cut. We saw the probabilities of a rate cut move from around 70% to closer to 60% this past that we see a rate cut in June.

For the July 30th meeting we have 22.1% now on a 25-basis point cut falling from 31.8% in the prior week. The odds are now 47.5% that we see 50 basis points of cuts by July falling from 48.7% in the previous week. With 27.3% on a 75-basis point cut rising from 18.6% in the prior. With now 3.1% on a 100 basis points of cuts and as of this weekend, we have no chance of a hold in July.

- Equity Market +

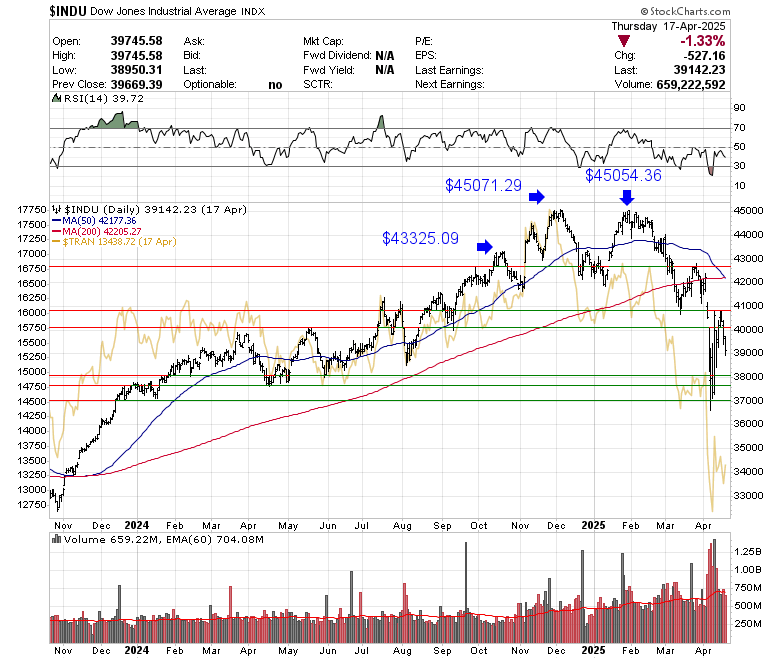

The Dow Jones Industrials fell by 1.14% to close at $39142.23 last week. It was a negative earnings report that helped pushed the index into the red as United Healthcare was lower by 23.60%. But we also saw NVDA falling by 5.65% and Amazon by down 4.75% which rounded out the three worst performers in the Dow Jones. While on the upside, it was JNJ rising 5.90%, Travelers moving up by 4.36%, and Procter and Gamble higher by 4.32% that rounding out the top three biggest winners. The Dow Transportation average, in yellow, was up 0.85% closing at $13428.72 over 2.000 points under the 200-Day average at $15885.72.

The S&P 500 last week was up by 0.28% to close at $5282.70 and found support around $5225 at the lows this past Wednesday. There was notable strength last week in the S&P 500 equal weight which moved up by 1.86%, not pictured, as the whole of the market did much better than the bigger heavily weighted technology companies which struggled last week outside of Apple. We have solid resistance building around $5450-$5500. Conversely, if the $5225 support level fails, there is support at $5100.

Since I last highlighted the index, the S&P 400 mid-caps have sustained considerable technical damage. The trend broke a few months back around $3100 and bottomed out near $2500. There was notable relative strength last week as the index rose by 2.23% holding above the 200-Day now for two consecutive weeks closing at $2744.39. If we can regain $2800 and then $2900, it would signal that the risk appetite in the markets is increasing and would be a positive development. Though the longer we stay underneath $2800, the more likely there would be for a test of the bottom at some point. My base case is for a W bottom as opposed to a V bottom.

The QQQ Trust moved lower by 0.47% as the Mag 7 and weakness in technology stock such as Meta, Nvidia, Microsoft, and Amazon led the selling with only Apple up in the week. We bottomed out at $437.76 last Wednesday and had an inside day on Thursday, as price action stayed contained in the prior day’s ranges. We now have areas of support around $441, below that $437 and then $430. On the upside, there is resistance at $447.50 and then $450 and above that $452.50. A breakout here could push the index back above $456, with potential resistance around $461.

The Russell 2000 was up by 2.63% this past week outperforming the S&P 500 and QQQ Trust. This after 2025 has seen the Russell 2000 consistently underperforming the major averages, so it was a small reprieve relatively. Now we have to watch if this outperformance is a sign of a trend reversal or just a weekly bounce. There is resistance just above at $190 and then around $195/$196. Support levels are around $183, then below at $177–$178.

- Commodity & Dollar +

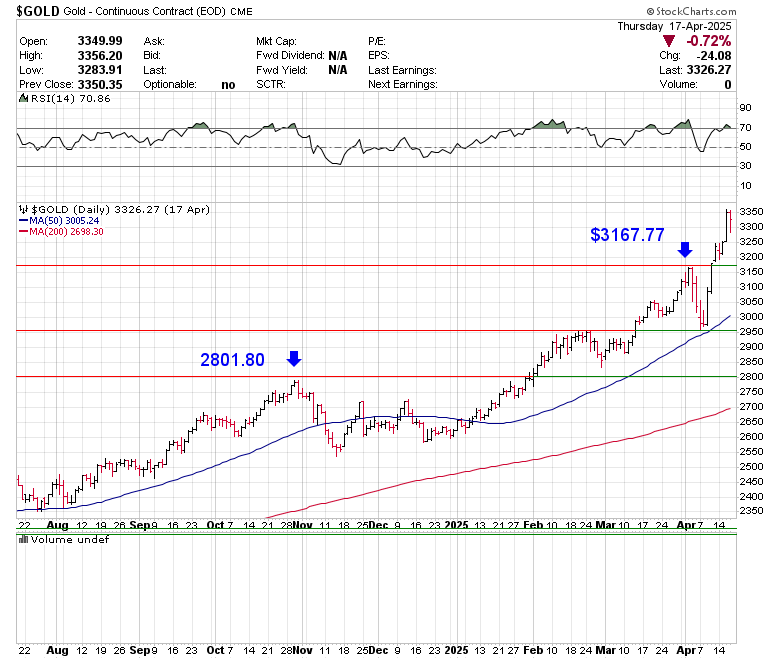

Gold rose again with a 4.65% move higher as the last two weeks of trading has been wild with $3357.57 marking the high on Wednesday. This was yet another record high as just this year in 2025 the metal is up 26.87%. We have support around $3170/$3200 and below that possibly at $3050 or near $3100 which could be considered trend support as well.

The US Dollar index fell again by 0.53% but we are still above the lows from two weeks ago closing at $99.23 this past week. The dollar’s continued decline suggests the move lower isn’t finished, and another week below $100 would further increase the likelihood of new lows in the short term.

WTI crude had a strong move back to the upside closing at $64.68 and is now in the process of testing the resistance around $65 which was supported for many years. This key area could signal our position in the recovery process; if oil holds above $65, the global recession may be cancelled or merely paused. If oil can’t regain this area, we could see a retest of the lows at $56 a barrel in the coming weeks and months.

Silver moved higher with a 4.19% surge this past week closing at $32.51 closing .01 above its 50-Day SMA. Recent highs in last March were at $34.58, which is the next area of considerable resistance. With the sharp moves in gold, it would not be surprising if we saw Silver continue to move higher in the next few weeks.

Copper moved higher yet again after the test of the uptrend just two weeks ago at $4. The metal closed at $4.70 up by 7.70% last week. Which puts it back in the middle of the uptrend, which started back in the summer of 2022.

Bitcoin moved up less than 1% this past week and is right now trading around 84K-$85K. Holding above both the 50-Day SMA and 30-EMA right now as the RSI remains over 50, signaling a move higher in the coming days and weeks.

- Sector Performance -

It was energy (XLE), real estate (XLRE), and the materials (XLB) which led the move higher. While we saw consumer discretionary (XLY), technology (XLK), and communication services (XLC) being the only sectors negative last week. On the month we still see technology (XLK) and energy (XLE) as the weakest areas in the market while utilities (XLU) and real estate (XLRE) have held up the best.

- Earnings -

This week we get key reports from Tesla, Verizon, Lockheed, Intuitive Surgical, SAP, IBM, Chipotle, Service Now, Alphabet, American Airlines, PepsiCo, and T mobile among many others.

- Major Economic and FED speaker highlights for the week ahead -

Monday, April 21st

6 am IMF Meetings

8:30 am Fed Goolsbee Speaks

10 am US Leading Index (MoM) (Mar) – Forecast -0.5% Prior -0.3%

11:30 am 3/6-Month Bill Auction – Prior 4.225% / 4.060%

Tuesday, April 22nd

6 am IMF Meetings

8:55 am Redbook (YoY) – Prior 6.6%

9 am Fed Governor Jefferson Speaks

9:30 am FOMC Member Harker Speaks

10 am Richmond Manufacturing Index (Apr) – Forecast -6 Prior -4

10 am Richmond Manufacturing Shipments (Apr) – Prior -7

10 am Richmond Services Index (Apr) – Prior -4

1 pm 2-Year Note Auction – Prior 3.984%

1 pm M2 Money Supply (MoM) (Mar) – Prior 21.67T

2 pm FOMC Member Kashkari Speaks

4:30 pm API Weekly Crude Oil Stock – Forecast 2.400M

6 pm FOMC Member Kugler Speaks

Wednesday, April 23rd

6 am IMF Meetings

7 am MBA 30-Year Mortgage Rate – Prior 6.81%

7 am MBA Mortgage Applications (WoW) – Prior -8.5%

7 am MBA Purchase Index – Prior 164.2

7 am Mortgage Market Index – Prior 267.5

7 am Mortgage Refinance Index – Prior 841.9

8:30 am Building Permits (Mar) – Forecast 1.482M Prior 1.459M

8:30 am Building Permits (MoM) (Mar) – Forecast 1.6% Prior -1.0%

9 am Fed Goolsbee Speaks

9:30 am Fed Waller Speaks

9:45 am S&P Global Manufacturing PMI (Apr) – Forecast 49.3 Prior 50.2

9:45 am S&P Global Composite PMI (Apr) – Prior 53.5

9:45 am S&P Global Services PMI (Apr) – Forecast 52.9 Prior 54.4

10 am New Home Sales (Mar) – Forecast 680K Prior 676K

10 am New Home Sales (MoM) (Mar) – Forecast 1.8%

10:30 am Crude Oil Inventories – Prior 0.515M

10:30 am EIA Refinery Crude Runs (WoW) – Prior -0.063M

10:30 am Crude Oil Imports – Prior -2.044M

10:30 am Cushing Crude Oil Inventories – Prior -0.654M

10:30 am Distillate Fuel Production – Prior 0.030M

10:30 am EIA Weekly Distillates Stocks – Prior -1.851M

10:30 am Gasoline Production – Prior 0.466M

10:30 am Heating Oil Stockpiles – Prior 0.019M

10:30 am EIA Weekly Refinery Utilization Rates (WoW) – Prior -0.4%

10:30 am Gasoline Inventories – Prior -1.958M

1 pm 5-Year Note Auction – Prior 4.100%

2 pm Beige Book

Thursday, April 24th

6 am IMF Meetings

8:30 am Chicago Fed National Activity (Mar) – Prior 0.18

8:30 am Continuing Jobless Claims – Forecast 1,885K

8:30 am Core Durable Goods Orders (MoM) (Mar) – Forecast 0.2% Prior 0.7%

8:30 am Durable Goods Orders (MoM) (Mar) – Forecast 1.5% Prior 1.0%

8:30 am Durables Excluding Defense (MoM) (Mar) – Prior 0.8%

8:30 am Goods Orders Non-Defense Ex Air (MoM) (Mar) – Prior -0.2%

8:30 am Initial Jobless Claims – Prior 215K

8:30 am Jobless Claims 4-Week Avg. – Prior 220.75K

10 am Existing Home Sales (Mar) – Prior 4.14M Prior 4.26M

10 am Existing Home Sales (MoM) (Mar) – Actual -3.0% Prior 4.2%

10:30 am Natural Gas Storage – Prior 16B

11 am KC Fed Composite Index (Apr) – Prior -2

11 am KC Fed Manufacturing Index (Apr) – Prior 1

11:30 am 4/8-Week Bill Auction – Prior 4.240% / 4.235%

1 pm 7-Year Note Auction – Prior 4.233%

1 pm Atlanta Fed GDPNow (Q1) – Estimate -2.2%

4:30 pm Fed's Balance Sheet – Prior 6,727B

4:30 pm Reserve Balances with Federal Reserve Banks – Prior 3.280T

5 pm FOMC Member Kashkari Speaks

Friday, April 25th

6 am IMF Meetings

10 am Michigan 1-Year Inflation Expectations (Apr) – Prior 6.7%

10 am Michigan 5-Year Inflation Expectations (Apr) – Prior 4.4%

10 am Michigan Consumer Expectations (Apr) – Prior 47.2

10 am Michigan Consumer Sentiment (Apr) – Prior 50.8

10 am Michigan Current Conditions (Apr) – Prior 56.5

1 pm U.S. Baker Hughes Oil Rig Count – Prior 481

1 pm U.S. Baker Hughes Total Rig Count – Prior 585

3:30 pm CFTC Net Speculative Positions:

– Aluminum 1.1K

– Copper 19.5K

– Corn 234.2K

– Crude Oil 146.4K

– Gold 202.2K

– Nasdaq 100 31.8K

– Nat Gas -117.1K

– S&P 500 -63.1K

– Silver 43.9K

– Soybeans 50.2K

– Wheat -88.3K

- Conclusion -

Last week we saw Powell talk of no rate cuts coming immediately that weighed on market sentiment even as the Fed fund futures market has now priced in a 100% of a chance for a rate cut of some form by July. This is because, with the effects of the tariffs and government firings, there will surely be a rise in unemployment and a weakening of the economy in the next few months. I think it’s really just a question of to what degree at this point in time. The reality is interest rates will probably fall in sympathy with the economy. But until the Fed sees the path the economy takes, they won’t be changing their current focus on price stability. While we could have a deal struck any day, even in a preliminary form, these could take months to transpire in a probable sense, if not years. While this market is very susceptible to any positive headlines related to tariffs as we get deeper into earnings seasons this upcoming week, the negative reports and forecast should keep a lid on any considerable rally in the coming weeks.

Personally, I think the odds are firmly in the court of a more W shaped bottom than the typical V bottom we see in shallow pullbacks in a Bull Markets. While I don’t know if the market will go lower than our recent lows a few weeks back. I think this process will take time and the current uncertainty likely to persist for months at a minimum. We still haven’t had a serious economic pullback and if we get this, it could create the negative sentiment needed for a retest of the lows. My base case scenario is that we will see consolidation and a lower pivot in the coming months before we get an all-clear. The situation is fluid, with a wide range of outcomes, and neither the administration nor Trump can predict its ultimate impact. So, we have to continue to analyze this situation as it develops and weigh the effects as they become known or probable.

This week’s economic calendar features key data and Fed speak that could shape market sentiment and rate expectations. The week begins with IMF Meetings and a speech from Fed Goolsbee, followed by the US Leading Index (Mar), which is expected to post another decline, signaling continued weakness in economic momentum. Tuesday brings several Fed speakers—Jefferson, Harker, Kashkari, and Kugler—along with the Richmond Fed Manufacturing Index, forecast to remain in contraction at -6, and the latest M2 money supply figures. On Wednesday, housing and PMI data take center stage. Markets will watch for a potential rebound in Building Permits and New Home Sales, while S&P Global PMIs are expected to show further softening in both manufacturing (49.3 forecast) and services (52.9 forecast). The Beige Book release may provide anecdotal evidence of regional economic shifts. Thursday features a heavy slate, with a focus on durable goods orders, where headline growth of 1.5% is expected but with weaker core readings. Jobless claims and the Atlanta Fed’s GDPNow estimate (currently -2.2%) will also be closely watched, along with existing home sales, which are coming off a 3.0% monthly drop. Friday rounds out the week with the final University of Michigan consumer sentiment data and inflation expectations, which will help gauge how anchored consumers’ outlooks remain.

That’s it for this week’s report. Have a good one.

Eric