TMT Market Report #136

Trump and Xi talk as the bromance between the President and Elon sours with equity market's continuing to climb. What will this week bring?

Welcome to The Merciless Trade, where I break down significant updates in the financial markets and find connections between them. Preparing you for the week ahead as I flip through charts, analyze the data, and cut through the noise to get an edge.

Now let’s do this…

For the past week, markets have continued to rise, with risk assets such as the Russell 2000 leading the way. We saw the Dow Jones Industrials and S&P 500 up over 1% with the QQQ Trust up just over 2%. While the Russell 2000, a basket of small-cap stocks moved up by over 3% over the past week. These moves occurred on the heels of Trump and Xi talking directly for the first time since the tariffs and trade negotiations started. Also, they will restart trade talks with their respective teams on Monday in London. If any constructive news comes from these talks next week, it would be a significant sign, but I wouldn’t expect much more than some loose framework, as this is a hard nut to crack. The reality is this could take years to flush out a concrete agreement, and that’s if everything goes well, but the market should respond well to any positive news that comes out of London.

Also last week we saw a public meltdown of the relationship between Donald Trump and Elon Musk which looks fractured beyond repair. Without delving too deeply into the matter, heated personal attacks were made by both sides, with threats of monetary retaliation prominent. While the situation has cooled down, it looks like Elon is pushing to start a movement for a third party, which is something I think America needs. Regardless, this situation could hurt Tesla, as Elon has been dealing with brand damage already from his work with DOGE, and now we have a serious fracture of his relationship with the government and Trump. This could continue to weigh on Tesla, and over the long-term even Trump with potential fractures from within the Republican party. It’s too early to draw any serious conclusions from this public spat, but with the two forceful personalities and insults that were flung, I find it hard to believe they become close again.

Economically last week we continued to see the U.S. economy slow even as the NFP this past Friday came in above expectations at 139K though we saw revisions for the two previous months moving down 95K. This is important to monitor over the next two months as often prior to a serious slowdown, we see revisions continue to push NFP numbers lower. The good news is the economy as of today is seeing a gradual decline, maybe even a goldilocks scenario, the so-called soft landing. Last week the ISM Non-Manufacturing PMI crossed under 50(49.9) for the first time since June 2024. This was a significant drop from the previous months’ reading, or the market expectations that were at 52. While we continued to see the ISM manufacturing PMI slip further into contraction territory for the third straight month. Below is a comparison of the manufacturing and services PMI over the past 15 years.

Here are the other economic data highlights from the past week:

Nonfarm Payrolls (May) 139K Vs 126K Est: 147K Prior

Unemployment Rate (May) 4.2% Vs 4.2% Expected

Average Hourly Earnings (MoM)(May) 0.4% Vs 0.3% Est.; 0.2% Prior

Imports For April 351.00B Vs 419.00B Prior

Exports For April 289.40B Vs 278.50B Prior

Nonfarm Productivity (QoQ) Q1 1.5% Vs -0.8% Est: -1.7% Prior

Trade Balance (April) -61.60B Vs -67.60B Est: -138.30B Prior

Initial Jobless Claims 247K Vs 236K Est.; 239K Prior (Revised From 240K)

Gasoline Inventories 5.219M Barrel Build Vs 1.500M Barrel Build Est.; 2.441M Barrel Draw Prior

EIA Weekly Distillates Stocks 4.230M Barrel Build Vs 2.200M Barrel Build Est.; 0.724M Barrel Draw Prior

Crude Oil Inventories 4.304M Barrel Draw Vs 2.900M Barrel Draw Est.; 2.795M Barrel Draw Prior

Durables Excluding Defense (MoM) For April -7.5% Vs -7.5% Est.; -7.5% Prior

S&P Global Services PMI For May 53.7 Vs 52.3 Est.; 50.8 Prior

ISM Non-Manufacturing Employment (May) 50.7 Vs 49.0 Prior

ISM Non-Manufacturing Business Activity (May) 50.0 Vs 53.7 Prior

ISM Non-Manufacturing New Orders (May) 46.4 Vs 52.3 Est.; 52.3 Prior

ISM Non-Manufacturing Prices (May) 68.7 Vs 65.1 Prior

ISM Non-Manufacturing PMI (May) 49.9 Vs 52.0 Est.; 51.6 Prior

S&P Global Composite PMI (May) 53.0 Vs 52.1 Est.; 50.6 Prior

ADP Nonfarm Employment Change (May) 37K Vs 111K Est.; 60K Prior

Factory Orders (MoM) (Apr) -3.7% Vs -3.1% Est.; 3.4% Prior

JOLTS Job Openings (Apr) 7.391M Vs 7.110M Est.; 7.200M Prior (Revised From 7.192M Prior)

Construction Spending (MoM) (Apr) -0.4% Vs 0.4% Est.; -0.8% Prior (Revised From -0.5%)

ISM Manufacturing PMI (May) 48.5 Vs 49.3 Est.; 48.7 Prior

ISM Manufacturing Prices (May) 69.4 Vs 70.2 Est.; 69.8 Prior

S&P Global Manufacturing PMI (May) 52.0 Vs 52.3 Est.; 50.2 Prior

- Treasury Market -

Bond yields flipped this week and rose across the curve with the 10-Year closing at 4.51% up by 10 basis points. We saw the 30-Year moving just under 5% going out on the highs Friday at 4.97% up 3 basis points. While the 2-Year closed at 4.05% up by 14 basis points on the week. So, it was the short end getting most of the activity which put the 2-Year very close to breaking out to multi month highs. Since liberation day, it was the long end leading bonds lower and yields higher but this week that dynamic broke down.

The 2-Year closed at 4.05%

The 5-Year closed at 4.13%

The 10-Year closed at 4.51%

The 20-Year closed at 5.00%

The 30-year closed at 4.97%

Concerning the June 18th Federal Reserve meeting, the probability of no rate cut is at 97.4% down from 97.8% in the prior, while the odds of a 25-basis point rate is at 2.6%.

For the July 30th meeting we have 83.3% chance up from 77.6% for a hold. The odds are now 16.3% that we see 25 basis points of cuts by July falling from 22%% in the previous week. We also now see a 0.4% chance of a 50-basis point cut falling from 0.5% in the prior.

For the September 17th meeting there is now a 51.8% chance we get 25-Basis point cut down from 57.8%. While there is an 8.8% probability of seeing 50 basis points of cuts down from 14.3% in the prior week. Followed by a 0.2% chance of 75 basis points of cuts. There is also a 39.2% chance that interest rates will remain steady down from 27.6% in the prior.

- Equity Market +

The Dow Jones Industrials Average moved higher by 1.17% last week as the Dow Transports in yellow below finished marginally higher with a 1.30% move. We are now right on a key resistance area for the Dow Jones which could very well turn to support if we continue to move higher. With the next area of considerable resistance around 44K. If the index can’t get going to the upside this week there is support below around 42K which has been providing support over the last few weeks.

The S&P 500 moved higher by 1.50% last week to close at $6000.36 as we are right at the 20% mark off the lows, which many would argue is the start of a bull market while others would say it ends with new all-time highs. Any which way you look at it this is significant, and the direction of travel is still pointing higher with little resistance in the index’s way to $6147.43. With the magnitude of the move and the markets internals improving daily it sure looks like we will make a run to all-time highs before the start of the next earning season over a month’s time. While we have seen a slowdown in the economy we haven’t seen anything worrisome yet, and this could surely change but the market is taking the bet it doesn’t as of today. If we do see a pullback, we have near-term support at $5920 and below that around $5850.

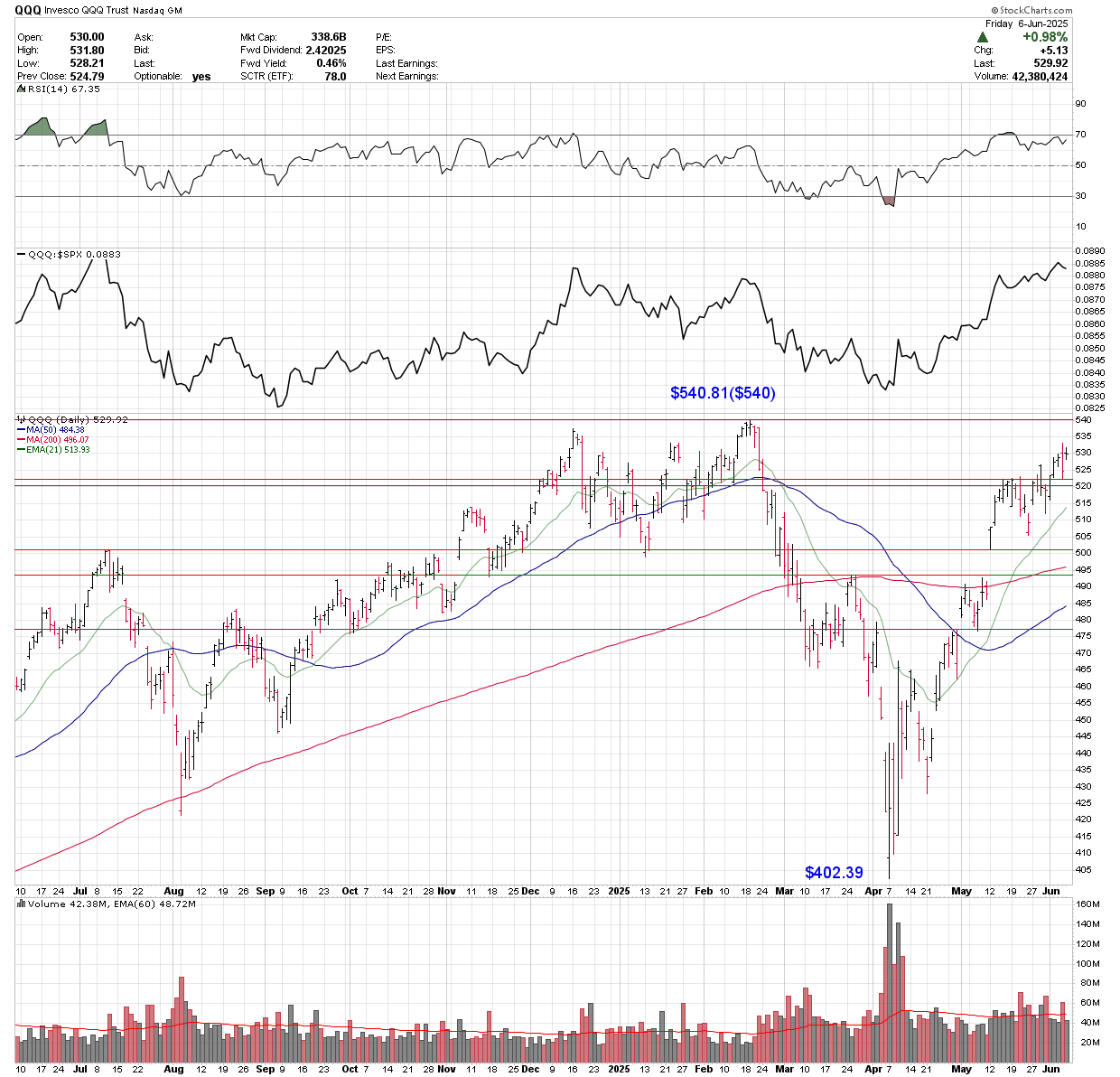

The QQQ Trust was higher by 2.08% closing just under a crucial area near $530. I continue to see signs of market internals improving and even though no one has a crystal ball; I feel new highs are now the most probable outcome. That said, we still have a July 9th date when reciprocal tariffs will expire and my assumption, like the market is they won’t be coming back on in the full capacity. That assumption is a bunch of deals will be struck, and if we don’t see a few trade agreements over the next few weeks this could add downside pressure. Just below we have support at $523 and under that, possibly around the $512 to $515 area.

The Russell 2000 last week was leading the move higher finally after months of underperformance with the index breaking above the downtrend and a key level around $210 on Friday. That said, this is a slight blip in the grand scheme of things as you can see on the indicator above the chart, which is the relative strength of the IWM compared to the S&P 500. If the index can stack a few solid weeks of out-performance here, we could see a full-fledged reversal, but as of now it’s still early. It looks promising for a move higher to $215 in the ST and if the index can get through $218, it could see a much bigger rally, even to the $225/$230 area. If we don’t rally further, we could see support around $207 and below that at $202.50. The Russell climbed 3.33% over the past week, closing at $211.90, which was the highest close since early March.

- Commodity & Dollar +

Silver was the biggest gainer in my market tracking portfolio this past week breaking out to 13-year high (Feb 2012) with a 9.03% weekly haul. We now have support around $35 and with the recent breakout I’m expecting a continuation of the recent rally as my base case with the next area of significant chart resistance at $37.50($37.46). If silver was to break that level, there is little in the way of resistance to $43/44 which is another peak in the wild year that was 2011. As of today, if we stay north of $35, which Is by in large what I expect. I think the next stop will be testing the area at $37.50.

The US Dollar index is trading near multi year lows falling by 0.14% to close at $99.19 last week. This has been the weakest start for the dollar ever, with an 8.57% decline so far in 2025. The market consensus is the dollar will continue to move lower and, for that reason, stronger data or positive news on trade could create a significant rally to the upside.

WTI crude had a big week with a 6.55% move to the upside. This is a huge week ahead, and if oil re-enters its previous range, it would signal a further rally may be just beginning. This would tell me that the possibility of a global recession is no longer a major concern for investors.

Silver clearly outshone gold last week as the relative outperformance took a back seat with only a 0.63% move to the upside. The commodity is hugging the 50-Day SMA around $3250 and if we see this level break, we could see a retest of support around $3170. Considering the scale of the move thus far in 2025, a pullback is unsurprising.

Copper last week was up by 2.97% closing at $4.81 but this was after a move to $5.04 on Thursday, which fizzled out. The metal is still on the upper end of the recent range and over the 50/200 SMA, with considerable chart support around $4.50.

Bitcoin is trading up about 1% over the past week, currently around 105K after a test of the 100K area just a few days ago near the 50-Day SMA. The token is now trading near its 21 EMA and a breakout back above $107K could be one to watch for to signal another move back to all-time highs is in the works.

- Sector Performance -

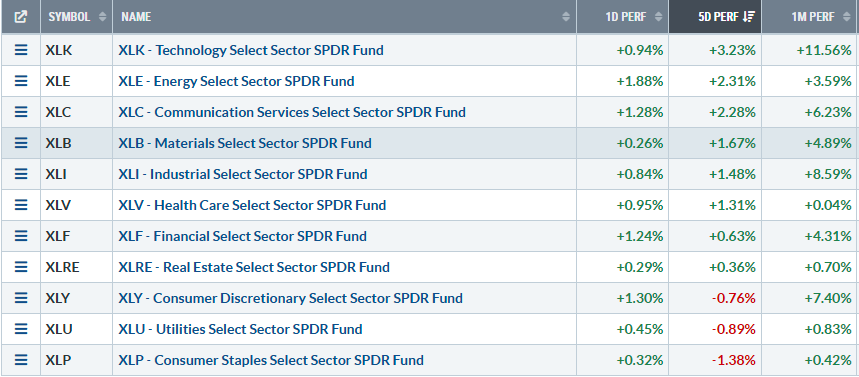

Over the past week, sector performance showed a clear tilt toward growth and cyclical sectors. Technology (XLK +3.23%) led the pack, followed closely by Energy (XLE +2.31%) and Communication Services (XLC +2.28%), signaling strength in both high-growth and commodity-tied plays. Materials (XLB +1.67%), Industrials (XLI +1.48%), and Financials (XLF +1.63%) also posted solid gains, reflecting broad participation across economically sensitive sectors. Defensive sectors like Health Care (XLV +1.31%) and Utilities (XLU -0.89%) lagged, while Consumer Discretionary (XLY -0.76%) and Consumer Staples (XLP -1.38%) underperformed. Real Estate (XLRE +0.36%) stayed mostly flat. Overall, the market appeared risk-on, favoring growth and inflation-linked sectors while shedding more defensive names.

- Earnings -

The week of June 9, 2025, features a diverse mix of earnings reports across retail, software, food, and consumer sectors. Key highlights include GameStop and GitLab reporting after Tuesday’s close, alongside PetMeds, Dave & Buster’s, and Stitch Fix. Chewy, Victoria’s Secret, SailPoint, and J.Jill report before Wednesday’s open, while Oracle and Oxford Industries follow after the bell. Thursday brings reports from Lovesac, Hooker Furnishings, and Establishment Labs before the open, with heavy-hitter Adobe and luxury retailer RH reporting after close. On Friday, the week wraps with MoneyHero before the market opens. Monday and Tuesday mornings also include less-followed names like United Natural Foods, J.M. Smucker, Designer Brands, and Core & Main, among others.

- Major Economic and FED speaker highlights for the week ahead -

Monday, June 9, 2025

🕓 10:00 – CB Employment Trends Index (May), prior 107.57

🕓 10:00 – Wholesale Inventories MoM (Apr), consensus 0.0%, prior 0.4%

🕓 10:00 – Wholesale Trade Sales MoM (Apr), prior 0.6%

🕓 11:00 – NY Fed 1-Year Consumer Inflation Expectations (May), prior 3.6%

🕓 11:30 – 3-Month Bill Auction, prior 4.250%

🕓 11:30 – 6-Month Bill Auction, prior 4.150%

🕓 13:00 – Atlanta Fed GDPNow (Q2), prior 3.8%, consensus 3.8%

Tuesday, June 10, 2025

☀️ 06:00 – NFIB Small Business Optimism (May), consensus 95.9, prior 95.8

☀️ 08:55 – Redbook YoY, prior 4.9%

🕓 11:30 – 52-Week Bill Auction, prior 3.930%

🕓 12:00 – EIA Short-Term Energy Outlook

🕓 13:00 – 3-Year Note Auction, prior 3.824%

🌙 16:30 – API Weekly Crude Oil Stock, prior -3.300M

Wednesday, June 11, 2025

☀️ 07:00 – MBA 30-Year Mortgage Rate, prior 6.92%

☀️ 07:00 – MBA Mortgage Applications WoW, prior -3.9%

☀️ 07:00 – MBA Purchase Index, prior 155.0

☀️ 07:00 – Mortgage Market Index, prior 226.4

☀️ 07:00 – Mortgage Refinance Index, prior 611.8

☀️ 08:30 – Core CPI MoM (May), consensus 0.3%, prior 0.2%

☀️ 08:30 – Core CPI YoY (May), consensus 2.9%, prior 2.8%

☀️ 08:30 – Core CPI Index (May), prior 326.4

☀️ 08:30 – CPI YoY (May), consensus 2.5%, prior 2.3%

☀️ 08:30 – CPI MoM (May), consensus 0.2%, prior 0.2%

☀️ 08:30 – CPI Index, n.s.a. (May), prior 320.80

☀️ 08:30 – CPI Index, s.a. (May), prior 320.32

☀️ 08:30 – CPI n.s.a. MoM (May), prior 0.31%

☀️ 08:30 – Real Earnings MoM (May), prior -0.1%

🕓 10:30 – EIA Weekly Petroleum Report:

– Crude Oil Inventories, prior -4.304M

– Refinery Crude Runs WoW, prior +0.670M

– Crude Oil Imports, prior +0.389M

– Cushing Inventories, prior +0.576M

– Distillate Production, prior +0.182M

– Distillates Stocks, prior +4.230M

– Gasoline Production, prior -0.714M

– Heating Oil Stockpiles, prior -0.282M

– Refinery Utilization WoW, prior +3.2%

– Gasoline Inventories, prior +5.219M🕓 11:00 – Cleveland CPI MoM (May), prior 0.3%

🕓 11:00 – Thomson Reuters/IPSOS PCSI (Jun), prior 49.95

🕓 13:00 – 10-Year Note Auction, prior 4.342%

🕓 14:00 – Federal Budget Balance (May), consensus -325.3B, prior +258.0B

Thursday, June 12, 2025

☀️ 08:30 – Continuing Jobless Claims, prior 1.904M

☀️ 08:30 – Core PPI MoM (May), consensus 0.3%, prior -0.4%

☀️ 08:30 – Core PPI YoY (May), consensus 3.0%, prior 3.1%

☀️ 08:30 – Initial Jobless Claims, consensus 241K, prior 247K

☀️ 08:30 – Jobless Claims 4-Week Avg., prior 235K

☀️ 08:30 – PPI YoY (May), consensus 2.6%, prior 2.4%

☀️ 08:30 – PPI MoM (May), consensus 0.2%, prior -0.5%

☀️ 08:30 – PPI ex Food/Energy/Transport YoY, prior 2.9%

☀️ 08:30 – PPI ex Food/Energy/Transport MoM, prior -0.1%

🕓 10:30 – Natural Gas Storage, prior +122B

🕓 11:30 – 4-Week Bill Auction, prior 4.170%

🕓 11:30 – 8-Week Bill Auction, prior 4.225%

🕓 12:00 – WASDE Report

🕓 13:00 – 30-Year Bond Auction, prior 4.819%

🌙 16:30 – Fed Balance Sheet, prior $6.673T

🌙 16:30 – Reserve Balances with Fed Banks, prior $3.362T

Friday, June 13, 2025

🕓 10:00 – Michigan 1-Year Inflation Expectations (Jun), prior 6.6%

🕓 10:00 – Michigan 5-Year Inflation Expectations (Jun), prior 4.2%

🕓 10:00 – Michigan Consumer Expectations (Jun), prior 47.9

🕓 10:00 – Michigan Consumer Sentiment (Jun), consensus 52.5, prior 52.2

🕓 10:00 – Michigan Current Conditions (Jun), prior 58.9

🕓 13:00 – Baker Hughes Oil Rig Count

🕓 13:00 – Baker Hughes Total Rig Count

🌙 15:30 – CFTC speculative positions (Aluminum, Copper, Corn, Oil, Gold, NDX, Nat Gas, S&P 500, Silver, Soybeans, Wheat)

- Conclusion -

Last week we saw some good signals for risk assets as the Russell 2000 is now above its downtrend and potentially breaking out. Another sign to watch in the week ahead would be for the S&P 400 Midcaps to break back over the 200-Day SMA and the $3100 level. Also, we saw oil, an indicator to me of the overall strength of the global economy rebound as well last week and a breakout above $65 would put oil back into previous ranges and signal more gains ahead for equities in a probable sense. These are important variables that I will continue to monitor over the summer to see how investors are perceiving the current economy and stock market outlook. This is a big week ahead and confirmation of last week’s moves, with a further upside move or consolidation even in these indexes and commodities would be bullish.

This week’s U.S. economic calendar is packed with market-moving inflation data and key Treasury auctions. The spotlight is on Wednesday's CPI report, with May's Core CPI expected at +0.3% MoM and +2.9% YoY, while headline CPI is seen holding steady at +0.2% MoM and ticking up to +2.5% YoY—setting the tone ahead of next week's FOMC. Thursday follows with PPI figures, where producer prices are expected to rebound slightly after last month’s sharp drop. Labor market data includes initial jobless claims (Thursday, est. 241K) and NFIB small business optimism (Tuesday), while energy markets will watch the EIA reports (Wednesday/Thursday) and API stockpile update (Tuesday PM). The Treasury auctions over $100B in 3-, 10-, and 30-year notes this week, testing demand. We’ll also get the Atlanta Fed GDPNow update, WASDE, and the federal budget balance for May, which is projected to swing back into deficit. Expect elevated rate sensitivity and bond volatility around midweek as these are major bond auctions taking place in the week ahead.

Well, that’s its folks. I’m on vacation this week but will be back again next Sunday with the next market report. Have a good one and take care.

Eric