TMT Market Report #26

Volatility continues to contract as the market awaits more data and corporate earnings.

The market volatility countinues to fall as the Vix, a measure of the equity markets expectations based on the S&P index call and put options hit the lowest level since November 2021 this week. The general activity continues to indicate inflation slowing and business activity holding up. This is giving the Bulls the muscle to keep pushing on and not giving the bears anything substantial to bite into right now in the data.

The consensus is for the US market to hit a wall in the not-so-distant future as the bond market prices in 75 basis points of cuts through January 2024. Meanwhile, according to James Bullard, recession fears are overblown as the Fed will keep interest rates high for a considerable time.

While the spread between the Fed and bond markets expectations has shrunk, this disconnect still paints an expansive view of probable outcomes for the US economy over the next year.

In other economic news and events for the past week:

Empire State Manufacturing Index came in at 10.8 compared to the consensus expectation of -18.

Building Permits for March came in at 1.413M compared to 1.45M

Housing Starts for March came in at 1.42M compared to 1.40M

Initial jobless claims hit 245k beating the expectations of 240k

Continuing Jobless Claims 1,865K compared to the 1,820K expectations; Previous 1,810K

S&P Global Composite PMI (Apr) 53.5 52.8 consensus estimate - 52.5 Prior

Manufacturing PMI(Apr) was 50.4 compared to the 49.0 consensus expectations; 49.2 Prior

Services PMI (Apr) came in at 53.7 compared to the 51.5 consensus

While some of the data is concerning, the service sector continues to grow, and the manufacturing sector is now in positive territory as the pandemic tailwind pushes on. Also, the government is helping to supply a tailwind for growth, and if you look at the housing market and its related stocks. A recession doesn’t appear to be imminent.

In the bond market, this week's yields got an early bid with the Empire Survey on Monday, surprising the equity market to the upside. However, yields slowly pulled back in to finish the week, as the 10yr finished in the middle of the range, essentially closing up about five basis points to finish the week at 3.57%. The 2yr had a bit more range over the week’s trade as the bond had nearly a twenty basis point range while finishing similarly in the middle of the weekly range, ending at 4.1795%. The odds for a 25 basis point move at the next FED meeting on May 3rd is 89.1%.

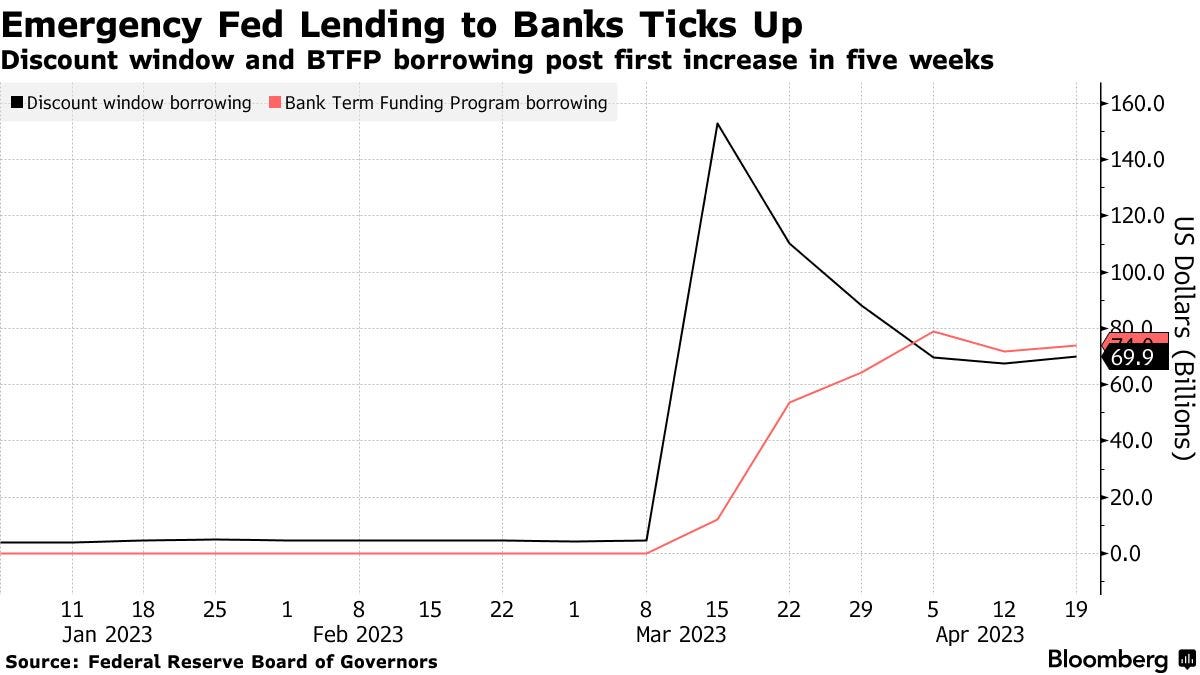

This past week the emergency lending through the Fed’s discount window ticked up for the first time in five weeks. While not overly concerning, the trend here over the next few weeks and months will be what truly matters.

Looking at earnings this week, we got some big names to help us better understand this economy's current state. I find, in particular, reports from Microsoft, Google, Texas Instruments, UPS, Meta, McDonald’s, 3M, CAT, Mastercard, Exxon, and Chevron as the highest probability for market-moving news. We also have PEP, RTX, HLT, CMG, JNPR, MRK, and INTC, which I have mentioned in our weekly TMT Stock Reports.

Below we are now looking at a daily chart of the S&P 500. You can see how the market's recent trend has stalled up at our resistance pivot over the past week. A pullback toward $4070.00-$4078.50 could be possible this week. In my estimation, the likelihood of further consolidation and a retreat in price this week is around 60%. That said, corporate earnings can swing the market back and forth on any given day, and this week could have some big surprises.

Looking at the Tech Heavy Nasdaq and the QQQ Trust consolidation was a theme of the week. Friday, we hit our pivot at $313-$314.25, and the upcoming week will likely have some more testing and bouncing around these levels. If these levels fail to hold, I believe a move toward the pivot at $306 would be the next likely stop.

With the recent underperformance in technology, XLK has been in the bottom three for sector performance over the last three weeks, which is no surprise. This week I will watch the index for the potential to lead the selling to the downside. If this market is to continue moving higher through the second half of this year, technology will have to come back into a leadership position.

Crude oil, which I use WTIC, pulled back this week, filling most of the gap after Opec + surprised the markets a few weeks ago with a million-barrel cut in output. The oil market is now on the 50-day SMA, which with other confluent factors, is chart support.

Bitcoin has pulled back significantly over the last trading week after hitting a high of over 31k just over a week ago this past Friday. The coin is now breaking under an area of support we have been using here at The Merciless Trade at around 28k. Lows over the weekend have been near 27k, and currently, the coin is trading at around $27,700. If Bitcoin breaks under 27k and the 50-day SMA at $26,900 currently, the next level would be about 25k.

On Thursday, the EU approved a comprehensive framework for Crypto regulation. I like and find it interesting that if you get one approval, you also get all the other EU member states approval.

The United States dropped the ball on this as legislation stalled late last year in Congress. All hope is not lost, but after a few high-profile failures, the climate in the US remains chilly.

- Notable on the week -

Over the last five trading days, the sector leaders XLP Consumer Staples was up 1.85%, XLRE Real Estate was up 1.58%, and XLU Utility was up 1.06%.

Laggards were XLC Communication Services falling by -2.60%; XLE Energy, down -2.58%; and XLK Technology, falling by -0.60%.

The Dollar continued to grind on this support area around $101, trading between $101-102 all week, as shown in the one-year daily chart below.

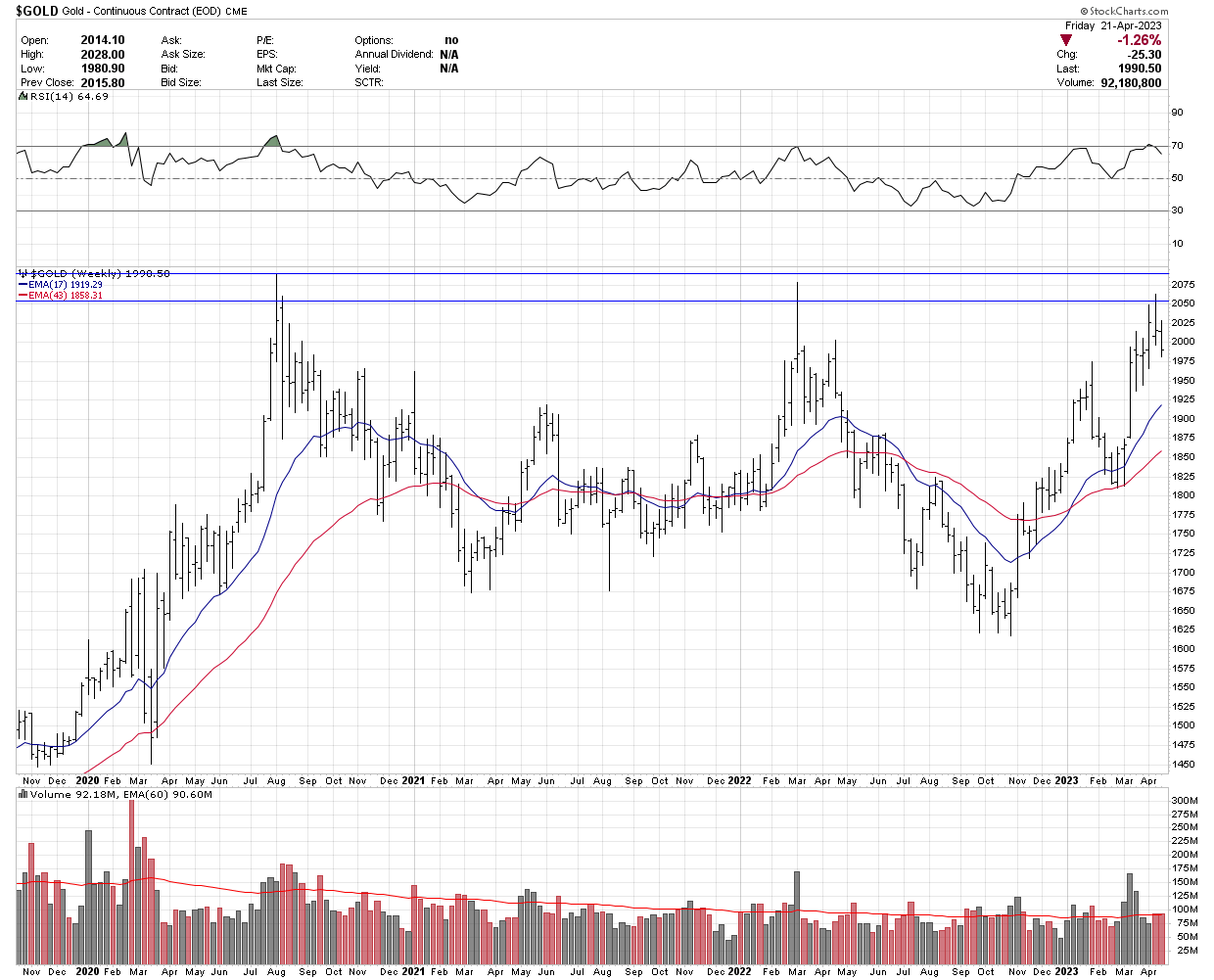

Gold pulled back this week, as you can see from the weekly chart of the continuous contract.

With the pullback in Gold, we also have a pullback in GDX, a gold miner ETF nearing a support area.

The Transports had some notable strength this past week, closing at the 50-day SMA and returning to the pivot the index has been trading around over the last year.

- Major Economic and FED speaker highlights for the week ahead -

Monday, April 24th

8:30 am Chicago Fed National activity(Mar) - Consensus??? Previous -0.19

10:30 Dallas Fed Mfg Business index - Consensus??? Previous -15.7

11:30 am 3 Month/6 Month Bill Auction

Tuesday, April 25th

8:55 am Redbook(YoY) - Consensus ??? - Previous 1.1%

9 am House price index(YoY)(Feb)

9 am S&P/CS HPI Composite - 20 n.s.a. (YoY)(Feb) - Consensus 0.1%

9:30 am Building Permits(MoM) - Consensus -8.8%

9:30 am building Permits - Consensus 1.43 M Previous 1.55 M

10 am CB Consumer Confidence(Apr) - Consensus 104.0

10 am New Home Sales(Mar) - Consensus 634k

10 am New Home Sales(MoM)(Mar) - Consensus 1.1%

4:30 pm API Weekly Crude Oil Stock - Previous

Wednesday, April 26th

8:30 am Core Durable Good Orders(MoM)(Mar) - Consensus -0.2%

8:30 am Durable Good Orders(MoM)(Mar) - Consensus 0.8%

8:30 am Goods Trade Balance(Mar) - Consensus -89.00 B

8:30 am Retail Inventories Ex Auto - Consensus 0.1%

10:30 am Crude Oil inventories - Consensus —1.088 M

1 pm 5yr Note Auction

Thursday, April 27th

8:30 am Initial Jobless Claims - Consensus 250k Previous 245k

8:30 am Continuing Claims - Consensus 1865k

8:30 am PCE Prices(Q1) - Consensus 0.5%

8:30 am GDP Price Index (QoQ)(Q1) - Consensus 3.8%

8:30 am GDP (QoQ)(Q1) - Consensus 2.0%

10 am Pending Home Sales(MoM)(Mar) - Consensus 0.3%

1 pm 7-year Note Auction

Friday, April 28th

8:30 am Core PCE Price Index(MoM)(Mar) - Consensus 0.3%

8:30 am Core PCE Price Index(YoY)(Mar) - Consensus 4.5%

8:30 am PCE Price Index(MoM) - Consensus ??

8:30 am Employment Cost Index(QoQ)(Q1) - Consensus 1.1%

8:30 am Personal Spending(MoM)(Mar) - Consensus -0.1%

9:45 am Chicago PMI(Apr) - Consensus 42.8

10 am Michigan Consumer Sentiment(Apr) - Consensus 63.5

10 am Michigan Consumer Expectations(Apr) - Consensus 61.8%

US Baker Hughes Oil Rig Count

4:30 pm CFTC Crude/Gold/S&P/Various Commodities speculative net positions

- Conclusion -

Looking across the equity complex, the gains in the last few weeks have been nothing but a grind. The Russel 2000 is weak, comprised of small-caps, and with relative strength in defensive sectors like utilities, consumer staples, and health care, the market rally appears to be on loose footing. Also, the most economically sensitive, consumer discretionary, and industrial stocks have been weak.

This doesn’t paint a compelling picture of the likelihood of this rally going into the summer. Though we have a wide distribution of probable outcomes in our view currently, as these economic realities narrow, I expect the direction of the next market pivot to become more apparent. As for now, we await more data and news to confirm or deny these various economic realities as the market’s volatility shrinks and equities consolidate.

Well, I hope you enjoyed this week’s market report, and don’t forget to check back in later this evening for the latest TMT Stock Report. Later.