I’ll start by talking about the standouts from my recent TMT Stock Reports:

AAPL - Continues to work higher as the trend is in place but ended the week slightly lower than where it started.

SNPS - Failed to hold the breakout as it went to $392.79 but sold off afterward and for the next two days to end the week in the recent range at 375.92.

EIX - Continued to breakout further this week, as defensive stocks had a strong showing of late.

CCEP - Made a run to new highs on Monday but failed to hold the breakout and pulled back on Tuesday to end the week lower.

INTC - Still above the pivot area, around $31, as it closed the week at $32.81.

SYK - Started the week on a significant pullback but finished higher on Monday and the week.

VRSK - above our pivot and mainly traded sideways over the last week.

WHR - Noticeable weakness to end week nearing support pivot.

Market Leaders

GOOG - I mentioned Alphabet in my first stock report, as is often the case; breakouts can take some time to develop for various reasons. Here I’m using the 107.50-108.75 as the pivot area. A big part of the breakout on Friday was the same reason it has been underperforming another big tech during this recent rally, Microsoft. The Bing Chatbox has pushed Google to add Bard to their engine.

CAH - Cardinal Health tapped new highs on Friday and pulled back under the pivot area we are using at $79.75-$80.50, and earnings are on May 4th.

CTRA - Coterra Energy is moving to the upper end of the price channel this week.

LMT - Lockheed Martin is another stock that tapped new highs in the Friday session before pulling back to close lower back under our pivot area. The move started Monday when the U.S. Army awarded Lockheed Martin a multiple-year $439M JAGM, HELLFIRE Production Contract. Earnings are on April 17th.

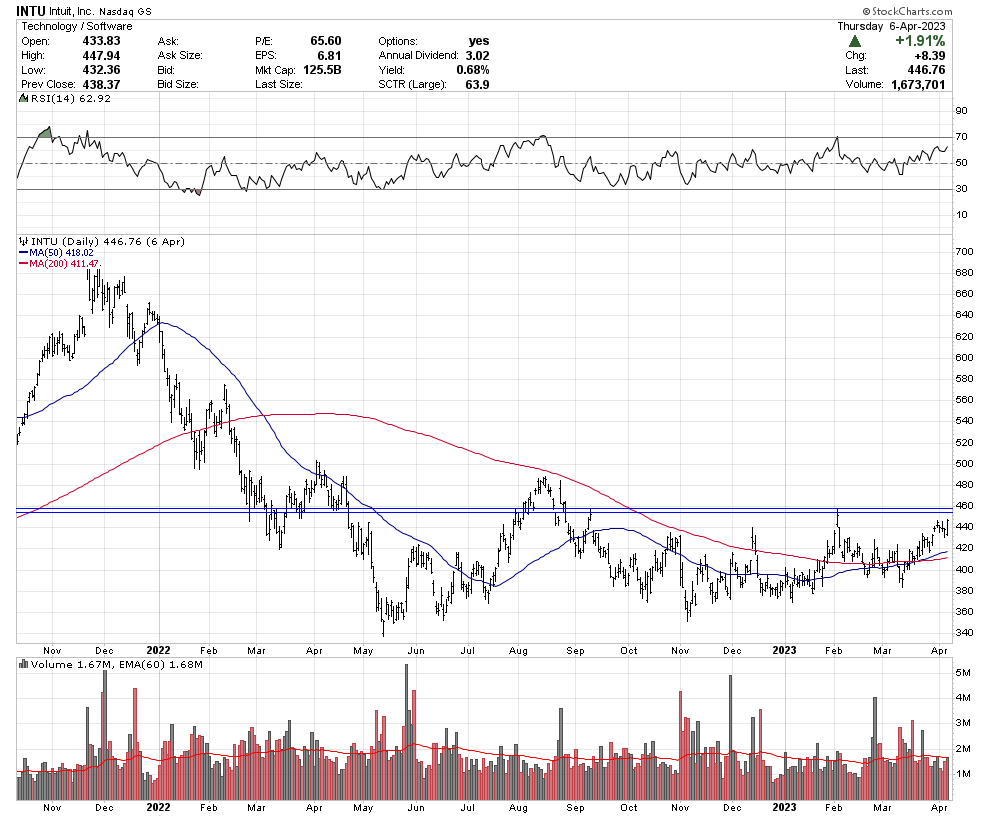

INTU - Intuit Inc. is nearing a breakout. The tax, accounting, and small business powerhouse reports earnings sometime at the end of May.

SOVO - Using $17.25-$17.40 as the pivot, it was incorporated in 2017, had an IPO about a year and a half ago, and sells products under the Rao’s, Michael Angelo’s, Noosa, and Birch Bender brands.

VERX - Up about 50 percent on the year, the stock is coming to a critical area and using $22.25-$22.85 as the multiyear resistance pivot area after breaking above the $19.50 area in late March. Vertex Inc. provides tax technology solutions for many industries.

MARA - Marathon Digital Holdings is a Bitcoin miner and is consolidating nicely. A breakout in the price of Bitcoin has the potential to get this stock running hard here, as it has been underperforming this move. Marathon holds in reserves 11466 BTC as of March 31st. Using $9.0-$9.5 as the pivot and the 200-day SMA is $8.99.

Market Laggards

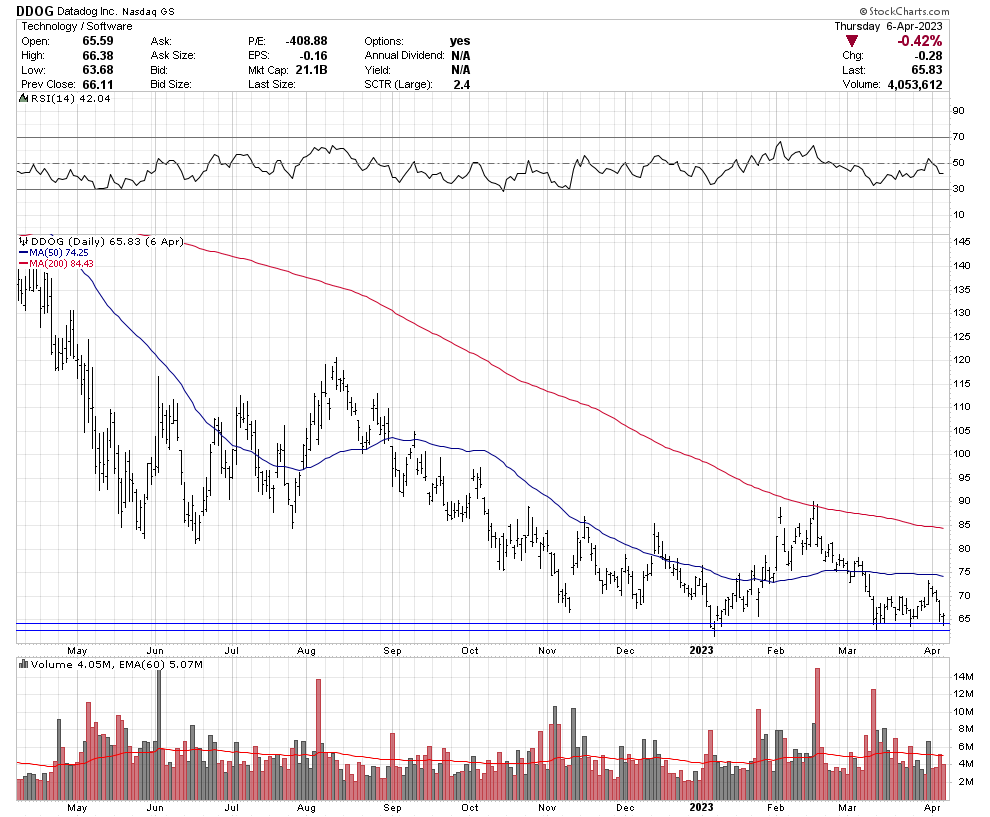

DDOG - Again traded down, closing near our lower support pivot after a strong close on Friday the week prior. Earnings should be coming out the first week of May.

ZS - Zscaler makes a list again as it taps new lows on Friday before a reprieve. Earnings are at the end of May.

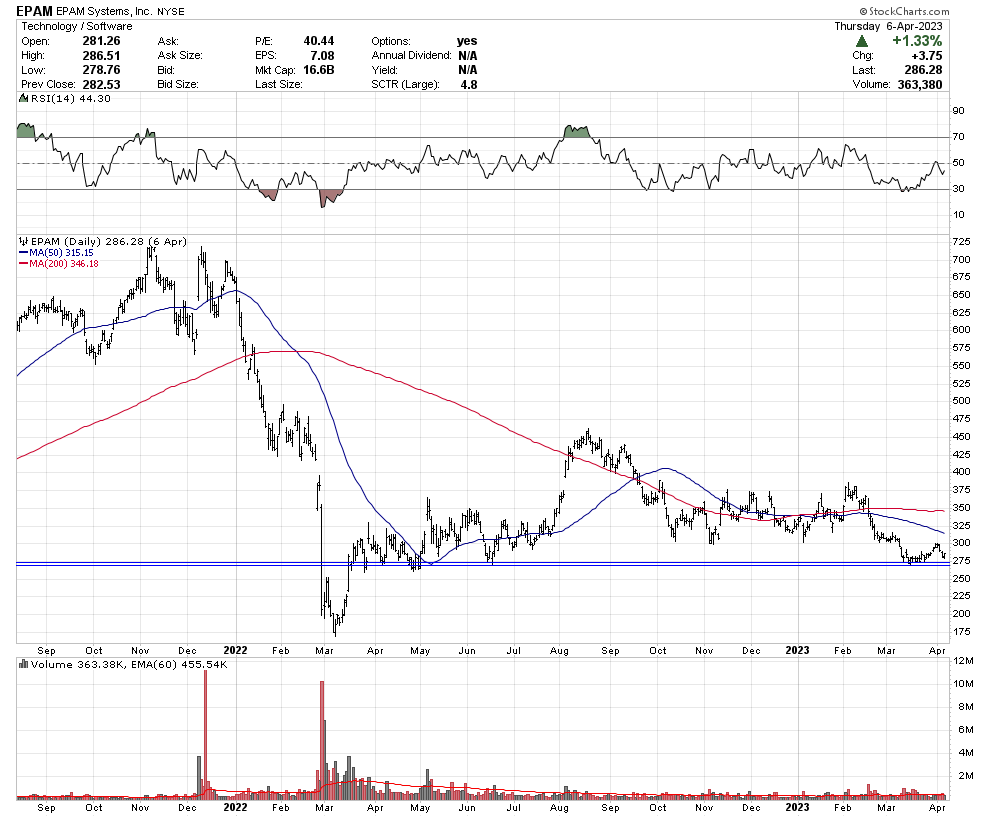

EPAM - Has earnings on Friday, May 5th, with an 8 am CC.

MHK - The maker of ceramic and hardwood flooring, Mohawk Industries, has earnings on April 27th.

MRK - A laggard by % this year compared to the indices, it’s been a strong stock over the last few years using $114-$114.75

PEP - Pepsico earnings are on April 25th, and the stock has been rallying in anticipation of them, still lagging behind the S&P 500 this year

Well, thanks for reading my latest weekly TMT Stock Report. I plan on going live over the next few weeks but would like to get more data into these reports and a modified layout on my Stock Report and Midweek Update by then. If you haven’t read my weekly Market Report, it is here. Until next week be good.