This week across the equity complex, volatility shrank, and stocks churned as Netflix and Tesla reported their earnings. I spun again through all the Nasdaq 100 and S&P 500 charts and looked through some of my favorite scans.

- Market Leaders -

AMZN - Finished at the 200-day SMA on Friday and showed relative strength this week ahead of their earnings this Thursday after the market’s close.

CRM - Stock has backtested the recent breakout in late March and is back up, testing those March highs again.

Top pivot $199.5-$200.15

LRCX - Lam Research reported quarterly earnings of $6.99 per share, beating the analyst consensus estimate of $6.54 by 6.88%. This is a 5.54% decrease over earnings of $7.40 per share from last year. The company reported quarterly sales of $3.87 billion, which beat the analyst consensus estimate of $3.83 billion by 1.04%. This is a 4.6% decrease over sales of $4.06 billion from last year.

Pivot at $538-$541.50 and early Feb high at $546.87

DXCM - Nearing a breakout with earnings this Thursday, the stock may continue to move higher into the report.

Pivot using $124.50-$125.55

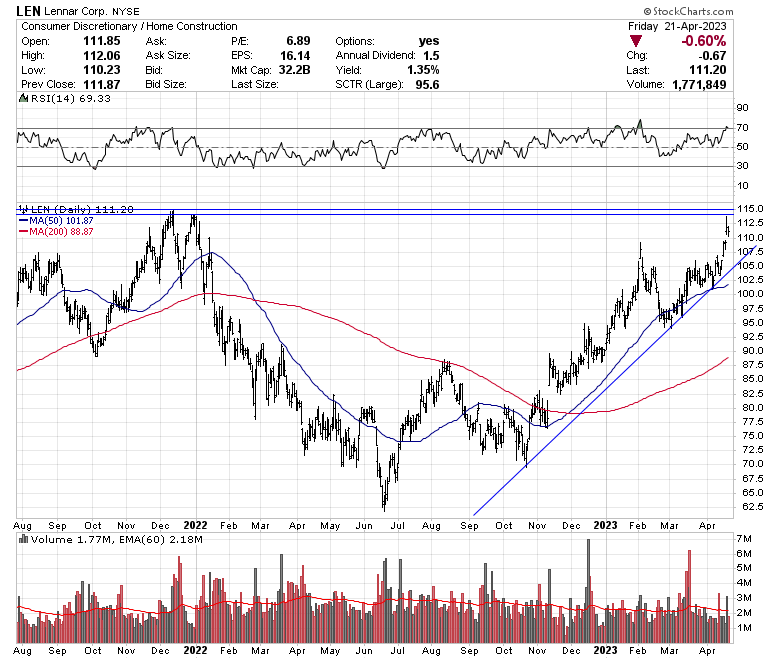

LEN - Lennar shares traded higher in sympathy with D.R. Horton, which reported better-than-expected Q2 EPS and sales results and issued FY23 revenue guidance above estimates on Thursday this past week.

Pivot $114-$115

TAP - Chart of good ole Molson Coors Brewing nearing a significant breakout and a multiyear high on the total return chart. Bud Lights recent PR snafu sparked the move higher in Molson’s stock. A six-year weekly chart below shows the stock breaking into the pivot area last week.

Pivot at $58.50-$58.85

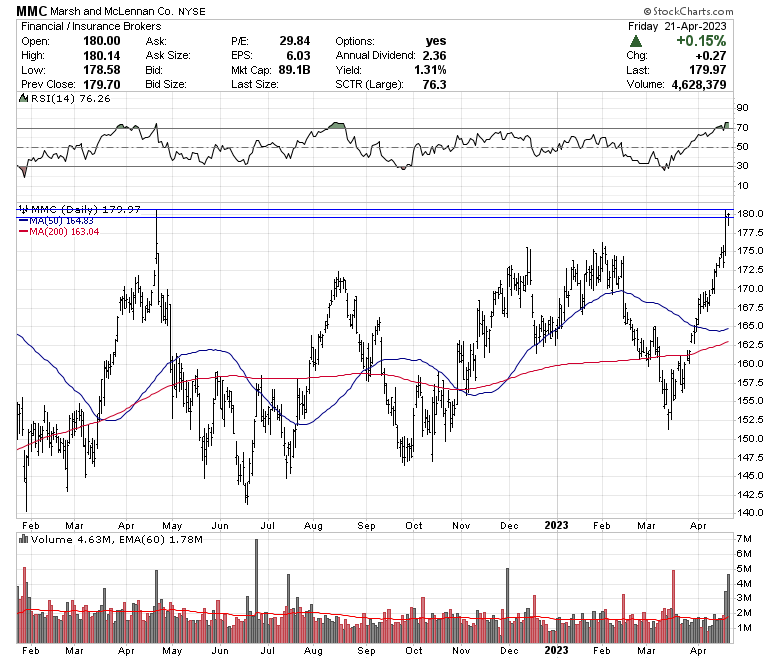

MMC - Marsh & McLennan, a professional services company that provides solutions to clients in risk, strategy, and people worldwide, reported quarterly earnings of $2.53 per share, which beat the analyst consensus estimate of $2.47 by 2.43%. This is a 10% increase over earnings of $2.30 per share from last year. The company reported quarterly sales of $5.92 billion, which beat the analyst consensus estimate of $5.87 billion by 0.85%. This is a 6.69% increase over sales of $5.55 billion last year.

Pivot $179.50-$180.50

OCUL - Ocular Therapeutix is a biotech company focused on therapies for diseases of the eye using its bioresorbable hydrogel-based formulation technology in the United States. The company also has a few clinical trials underway in various development stages and will report earnings in a few weeks.

Pivot $6.30-$6.55

CSIQ - Will be reporting earnings in about a month. Canadian Solar is currently triangulating, and a sharp move could be possible out of the tight range.

- Market Laggards -

ETSY - The online line marketplace for artisans will be reporting earnings on May 3rd, currently underperforming the market this year.

Pivot $99.40-$100.25

MDT - FDA approves Medtronic's MiniMed 780g system on Friday, sending the stock to 6-month highs hitting $88.13 during the day before pulling back and closing at $85.73.

$86.00-$87.25 as the pivot area.

RHI - Robert Half International provides talent solutions and business consulting services and will report earnings on April 26th. The stock has been weak and is struggling to stay positive in 2023.

Pivot $72.25-$73.00

KO - Coca-Cola will report before the opening bell on Monday morning and maybe tradable around the 2022 highs and pivot area.

Pivot $63.65-$64.25

- Past TMT Stock Report Notable-

AAPL - New highs of 2023 this week on Wednesday; earnings are May 4th.

MSFT - Pulled back ever so slightly this week.

ADSK - On support pivot, acting weak.

INTC - Pull back to our support area at around $30.

INTU - Traded up slightly this week, nearing the pivot mentioned back on TMT Stock Report #4.

PEP - Hit new highs on Thursday and Friday, closing in our pivot area. Earnings are on Tuesday morning.

CAH - In the pivot area, we use $70.75-$80.75.

CBZ - Mainly consolidation over the past week but all-time closing highs on Friday.

CBOE - Finished Friday by closing right into the highs of the week.

CTRA - Finished below the pivot we are using on Friday. The price of oil will be a factor here. Earnings are on May 4th.

EPAM - Coming back down to support after a two-week bounce-up.

GS - Crossing over the 200-day SMA average after weak earnings, notable strength.

HCA - HCA Healthcare reported quarterly earnings of $4.93 per share, which beat the analyst consensus estimate of $3.93 by 25.45%. This is a 19.66% increase over earnings of $4.12 per share from last year. The company reported quarterly sales of $15.59 billion, beating the analyst consensus estimate of $15.27 billion by 2.10%. This is a 4.32% increase over sales of $14.95 billion in the same period last year.

Also Revises FY23 revenues to $62.5B-$64.5B From $61.5B-63.5B compared to the consensus of $62.61B, with adjusted EPS of $17.25-$18.55 from $16.40-$17.60 compared to a consensus of $17.25.

KMB - Exploded higher on Friday, closing by 1.75% as the market bids up the stock ahead of their earnings this week.

MRK - Above the pivot a week after buying Prometheus Biotech.

RTX - Surged higher with Lockheeds earnings last week but ended up closing on the bottom of our pivot. Earnings are on April 25th, this Tuesday.

Below are all 16 stocks I wrote about above. Hopefully, this gives a better perspective.

- Conclusion -

Well, that’s it for this week's TMT Stock Report. If you haven’t read my recent Market Report, you can right HERE. Until then, have a great week, and take care.